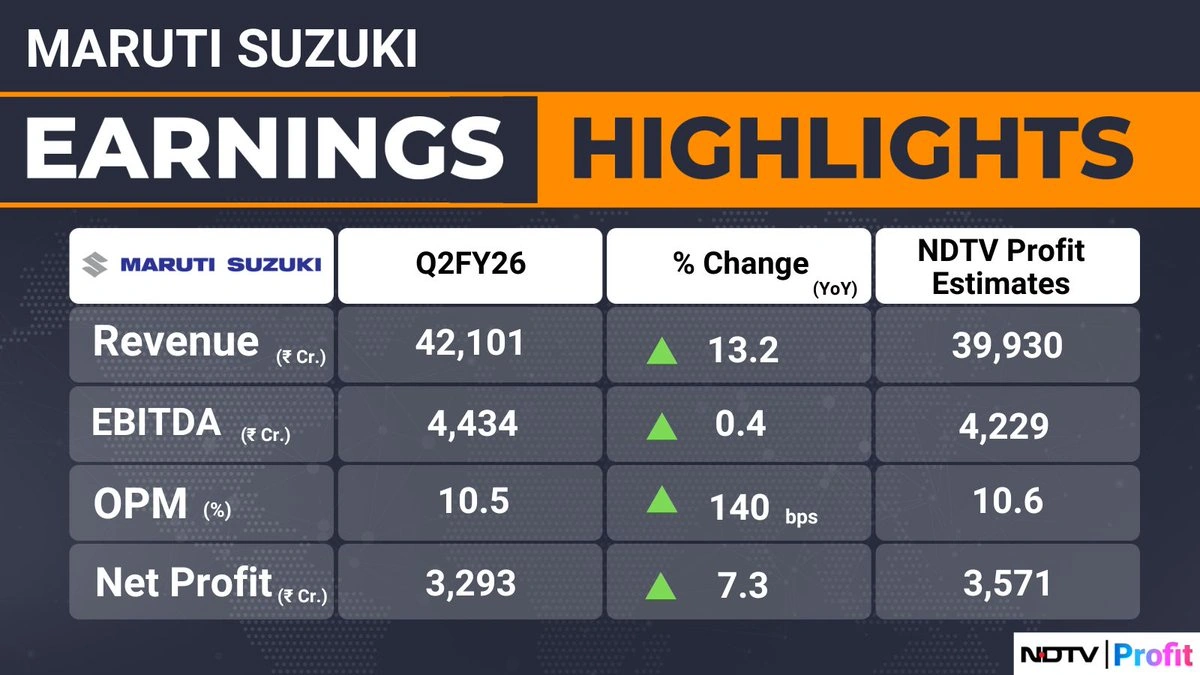

Okay, let’s talk Maruti Suzuki profit . We’ve all seen the headlines: Maruti Suzuki India is reporting an 8% jump in net profit for the second quarter, with revenue soaring by 13%. Big numbers, right? But what’s really going on here? It’s not just about the quarterly figures; it’s about the larger story of the Indian auto market, consumer behavior, and the overall economic landscape.

Forget the press releases for a minute. Let’s dig into the ‘why’ behind these numbers. Because honestly, that’s where things get interesting. I initially thought this was just another ‘good news’ story, but the more I looked into it, the more I realized it’s a sign of some fundamental shifts. And that’s what truly matters.

Decoding the Profit Surge | More Than Just Sales

So, what’s driving this profit increase? Obviously, increased sales play a part. But it’s not the whole picture. See, the automotive industry is complex. The Indian automotive industry is subject to several rules. It’s a cocktail of factors that need to be taken into account to properly evaluate its success.

One crucial element is the change in product mix. Are more people buying higher-margin vehicles? That would significantly impact profitability, even if the total number of units sold remains relatively constant. Think about it – a few extra sales of the Maruti Suzuki Jimny or Brezza can do wonders for the bottom line. And, of course, don’t forget the impact of price hikes. Let’s be honest – most car manufacturers have been steadily increasing prices over the past year, citing rising input costs. These incremental increases add up.

But there’s more. Let’s talk about cost optimization . It’s boring, but it’s vital. The company has likely been laser-focused on cutting costs across the board, from manufacturing to supply chain management. This includes negotiating better deals with suppliers, streamlining production processes, and maybe even reducing marketing spend (though that’s less likely, given how competitive the market is). I’ve seen companies squeeze out incredible profit margins simply by becoming hyper-efficient. Another factor to consider is the impact of currency fluctuations. A weaker rupee can make exports more competitive and boost revenue. But it can also increase the cost of imported components.

The Indian Consumer | Spending Habits and Future Trends

At the heart of any profit story lies the consumer. What are Indian consumers buying, and why? Are they still prioritizing fuel efficiency, or are they now more interested in features, safety, and status? This is key because consumer preferences dictate which models fly off the shelves and which ones gather dust. I see this all the time.

The rise of SUVs and crossovers is undeniable. Indian buyers are increasingly drawn to these vehicles, even in the compact segment. This is driven by a combination of factors: perceived safety, better ground clearance for rough roads, and simply the desire for a more imposing presence on the road.

Let’s not forget the growing importance of financing. Most car purchases in India are financed through loans. Interest rates, loan availability, and the overall lending environment play a huge role in determining demand. If interest rates are low and loans are readily available, more people are likely to buy cars. And that is a good thing!

Looking ahead, we need to consider the impact of electric vehicles (EVs). While EVs still account for a small percentage of total sales, their popularity is growing rapidly. How is Maruti Suzuki planning to compete in the EV space? Are they investing heavily in research and development, or are they taking a more cautious approach? This will be crucial for their long-term success.

The Competitive Landscape | Who’s Winning, Who’s Losing?

Maruti Suzuki isn’t operating in a vacuum. They’re facing intense competition from both domestic and international players. Hyundai, Tata Motors, Mahindra – they’re all vying for a bigger slice of the pie. And the competition is only getting fiercer. Here’s the thing, you may think that these are the only competitor but you must always think about the competitive dynamics that could change this landscape.

Are they gaining market share, or are they losing ground to competitors? Are they launching new models that are resonating with consumers? Are they adapting quickly enough to changing market trends? These are all critical questions. The success of competitors like Tata Motors, with their focus on design and safety, is putting pressure on Maruti Suzuki to innovate.

Also, global trends and technological advancements are shaping the competitive landscape. The rise of autonomous driving, connected cars, and shared mobility is forcing all automakers to rethink their business models.

Impact of Government Regulations and Policies

The Indian auto industry is heavily influenced by government regulations and policies. From emission norms to safety standards to taxation, the government plays a significant role in shaping the market. I see this all the time in the industry.

New regulations, such as the Bharat Stage VI (BS6) emission standards, have a direct impact on vehicle prices and technology. Government incentives for electric vehicles are also influencing consumer behavior and manufacturer strategies. Are government policies helping or hindering Maruti Suzuki’s growth? It’s a question worth asking. For example, changes in import duties on components can significantly affect manufacturing costs. Also, the government’s push for vehicle scrappage schemes can stimulate demand for new vehicles.

Here’s a link to related content . And here is another one: another link .

Looking Ahead | Challenges and Opportunities

So, what does the future hold for Maruti Suzuki? While the Q2 results are certainly positive, there are still plenty of challenges on the horizon. Rising input costs, supply chain disruptions, and increasing competition are all potential headwinds. However, there are also significant opportunities. The growing Indian economy, the rising middle class, and the increasing demand for personal mobility all bode well for the long term.

The company’s ability to adapt to changing consumer preferences, embrace new technologies, and navigate the regulatory landscape will determine its future success. Will they be able to maintain their dominant market share, or will they be overtaken by competitors? Only time will tell. What fascinates me is how they handle the pressure to go electric while still catering to the price-sensitive Indian consumer.

FAQ Section

Frequently Asked Questions

What factors contributed to Maruti Suzuki’s 8% net profit increase in Q2?

Increased sales, a favorable product mix (more high-margin vehicles), and cost optimization measures likely contributed.

How are changing consumer preferences impacting Maruti Suzuki?

The increasing demand for SUVs and feature-rich vehicles is forcing Maruti Suzuki to innovate and adapt its product line.

What role do government regulations play in Maruti Suzuki’s performance?

Government policies, such as emission norms and EV incentives, significantly influence Maruti Suzuki’s costs, technology, and sales strategies.

What are the key challenges facing Maruti Suzuki in the near future?

Rising input costs, supply chain disruptions, and increasing competition pose significant challenges.

Is Maruti Suzuki investing in electric vehicles (EVs)?

Yes, Maruti Suzuki has plans to introduce EVs, but the specific details of their strategy are still evolving.

Ultimately, the story of Maruti Suzuki’s Q2 profit increase is a microcosm of the larger Indian economy. It reflects the resilience of the Indian consumer, the dynamism of the automotive market, and the ever-present forces of competition and change. It’s not just about cars; it’s about India’s journey.